Advanced portfolio reporting

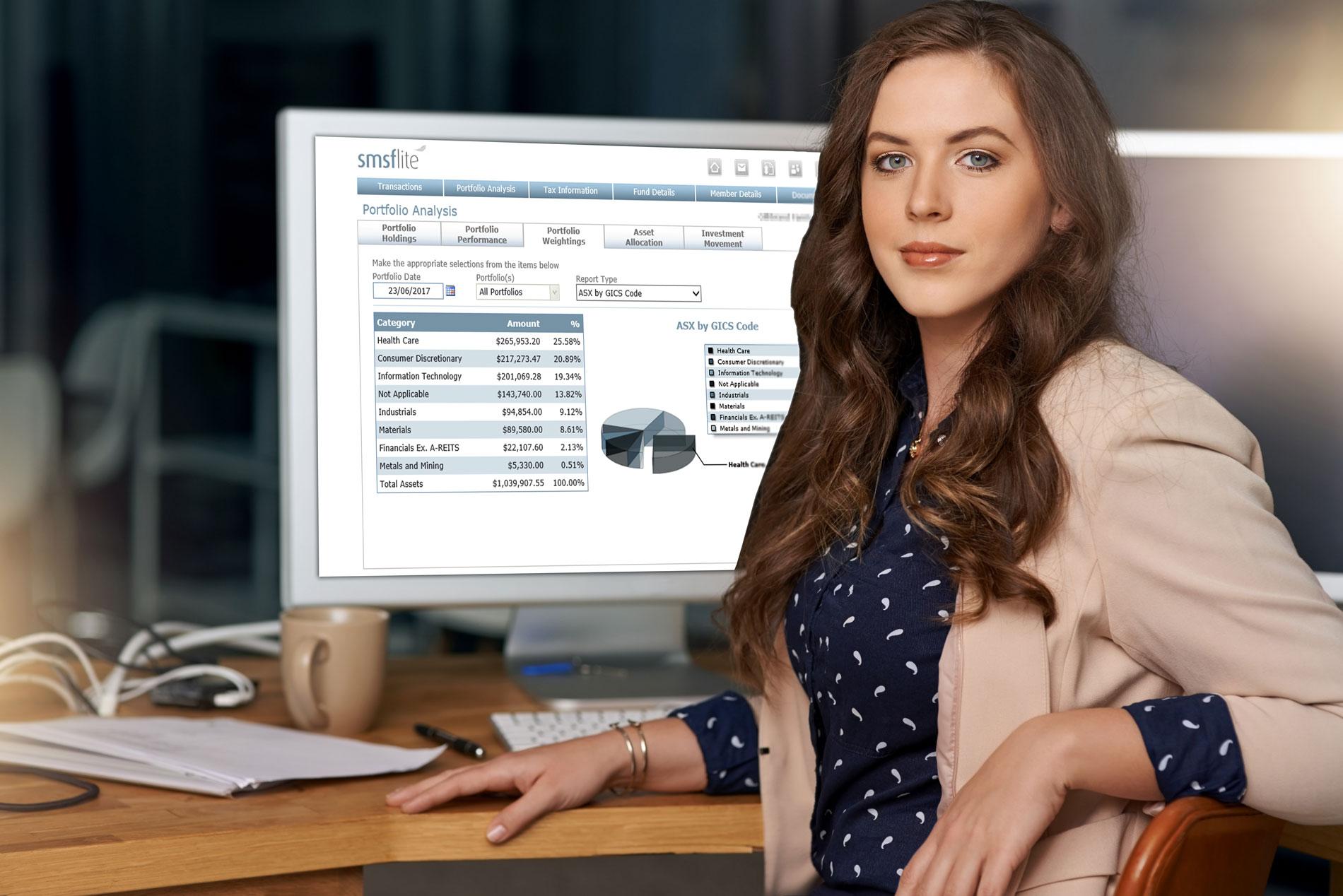

SMSF Lite’s portfolio reporting allows investment performance to be measured, monitored and analysed against pre-defined portfolios and benchmarks.

To enhance transparency and understanding, all investment performance calculations are available at individual parcel level, removing the traditional “black box” approach of internal rate of return calculation methodologies.

In addition, GIPS compliant reporting ensures all portfolio reporting is adjusted to account for the unique impact of capital inflows and outflows associated with SMSFs.

Of course, we also provide a rich array of tools, allowing you to seamlessness monitor portfolios against GICs codes, find which funds hold a specific security or review available cash balances for investment opportunities, as required.

To enhance transparency and understanding, all investment performance calculations are available at individual parcel level, removing the traditional “black box” approach of internal rate of return calculation methodologies.

In addition, GIPS compliant reporting ensures all portfolio reporting is adjusted to account for the unique impact of capital inflows and outflows associated with SMSFs.

Of course, we also provide a rich array of tools, allowing you to seamlessness monitor portfolios against GICs codes, find which funds hold a specific security or review available cash balances for investment opportunities, as required.